-

11/05/2016

-

Ad astra

-

Tax cuts for wealthy

In a piece published on 13 April, I predicted that

inequality would be a hot button issue in the upcoming election. Now that we have had both Scott Morrison’s budget speech and Bill Shorten’s speech in reply, we can see how this issue will play out in the election. Although the word ‘inequality’ has not assumed the repetitive status of the ‘jobs and growth’ mantra, it is subtly pervading the political discourse.

Every time the term ‘fairness’ is used, notions of equality are being canvassed.

In his reply speech, Shorten made a point of emphasising equality for women: “

championing the march of women to equality, closing the gender pay gap and properly funding childcare”. He spoke of fairness and integrity in superannuation, and asserted that “

Australia should never accept the false choice between growth and fairness - each is essential to each other.”

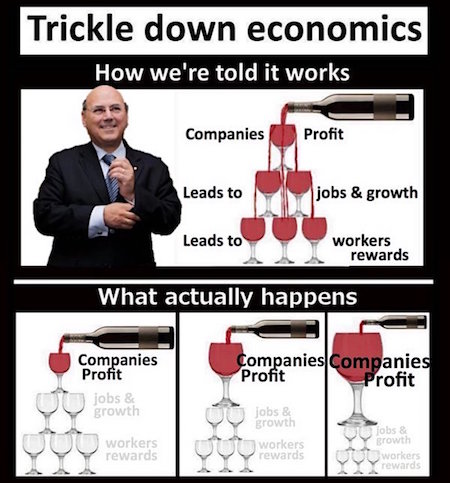

By now most readers of political blogs will be familiar with the term: ‘trickle down economics’, but for those who are not, let me give a short history of this concept. It is not a formal economic theory so much as a catchphrase that captures a concept that permeates the thinking of many politicians, namely that benefits given to those at the top will trickle down to those at the bottom.

The concept goes back a long way. Economist John Kenneth Galbraith noted that

‘trickle-down economics’ had been tried in the United States in the 1890s under the name ‘horse and sparrow theory’: “

If you feed the horse enough oats, some will pass through to the road for the sparrows.” Reaganomics was an example, and likewise Margaret Thatcher’s approach to economics.

In his book:

Zombie Economics: How dead ideas still walk among us (Princeton University Press, 2010), John Quiggin, Australian Laureate Fellow in Economics at the University of Queensland, described several discredited economic theories that refuse to die, living on as zombies that politicians still use to suit their political purposes. Among the zombies he listed was ‘trickle-down economics’. Although discredited, Quiggin warned that as a zombie that will not die, the concept would still be used:

“As long as there have been rich and poor people, or powerful and powerless people, there have been advocates to explain that it’s better for everyone if things stay that way.” This was elaborated upon in an April 2011 piece on

The Political Sword: Joe Hockey should read John Quiggin’s Zombie Economics.

While great economists such as Adam Smith, John Stuart Mills and John Maynard Keynes have supported income re-distribution through progressive taxation, and most economists still do today, there are still some who argue that we should let the rich get richer and wait for the benefits to trickle down to the poor. One could be forgiven for thinking that is what Joe Hockey, Scott Morrison, Malcolm Turnbull, and today’s Coalition members believe, as they insist on giving tax relief to the wealthy, but not to the less well off. This trend was starkly portrayed in the 2014 budget, and continues in 2016.

Quiggin gives example after example to demonstrate that the trickle down hypothesis is false, and caps this with a telling graph of household income distribution in the US from 1965 to 2005 that shows that those on the 95th percentile for income steadily improved their position by over fifty percent, while those on the 20th percentile and below were static.

He pointed out that the biggest challenge of the failure of the ‘trickle-down hypothesis’ is to understand why and how inequality increased so much under market liberalism, and how it can be reversed. To Quiggin, restoring progressivity to the tax system is seen as an obvious move.

For the academically inclined,

several varieties of inequality are recognized: Wikipedia says:

”Economic inequality is the difference found in various measures of economic well being among individuals in a group, among groups in a population, or among countries. Economic inequality is sometimes called income inequality, wealth inequality, or the wealth gap. Economists generally focus on economic disparity in three metrics: wealth, income, and consumption. The issue of economic inequality is relevant to notions of equity, equality of outcome, and equality of opportunity…There are various numerical indices for measuring economic inequality. A widely used index is the Gini coefficient, but there are also many other methods.

“Some studies show that economic inequality is a social problem; too much inequality can be destructive because it might hinder long-term growth. Others argue that too much income equality is also destructive since it decreases the incentive for productivity and the desire to take-on risks and create wealth”.

The latter is what conservatives believe.

A more familiar way of talking about inequality is to talk about ‘fairness’, a concept every Australian understands. The ‘fair go’ is valued by most of us. Who would argue against the idea that everyone should have a ‘fair go’?

Joseph Stiglitz is another who has been writing for years about the damaging effect of inequality. His book:

The Price of Inequality is a classic. More recently, Thomas Piketty entered the arena with his

Capital in the Twenty-First Century and hypothesized about the genesis of inequality. He asserted that the main driver of inequality, namely the tendency of returns on capital to exceed the rate of economic growth, today threatens to generate extreme inequalities that stir discontent and undermine democratic values. He reminded us that political action has curbed dangerous inequalities in the past and could do so again. But is the Coalition listening?

No matter who writes about inequality, the conclusion is the same: the gap between those at the top and those languishing at the bottom of the pile is widening in many countries, ours among them.

If you need any more evidence to convince you of the fallacy of the ‘trickle down’ concept, read:

The embarrassing truth about trickle-down on the

New Economics website,

NEF, the outlet of a UK think tank promoting social, economic and environmental justice.

The 2014 article by Faiza Shaheen concludes:

”The trickle-down approach has been bad economics. Not only has it failed to deliver on its own terms but also it has actively damaged the health of our economy, society and political system. It has supported growing inequality which, rather than boosting economic performance, has deflated it. The UK grew more when we were a more equal country during the post-war, pre-Thatcher era than after. Its damaging social effects are also mounting. High levels of inequality are increasingly seen as harmful to individual well-being and health, social cohesion and social mobility.

“Obama’s attack on trickle-down economics, echoed by Labour Leader Ed Miliband offered hope that our leaders are finally engaging in the possibility of dethroning this damaging philosophy, but the recent response to a potential increase in income tax shows that the theory still festers. We must continue to counter an approach that has created a tide of inequality that lifts up the yachts while leaving the rest of us paddling harder. By pulling the rug out from under trickle-down economics other damaging myths can be exposed, such as the argument for high executive pay.”

Read too

Elizabeth Warren demolishes the myth of “trickle-down”. “That is going to destroy our country, unless we take our country back” in

Salon. She is an academic and Democrat senator.

For Liberal skeptics here is the

coup de grace in

United Fair Economics in an article

Trickle-down economics: Four reasons why it just doesn’t work, written in 2003 during the Bush era:

- Cutting the top tax rate does not lead to economic growth

- Cutting the top tax rate does not lead to income growth

- Cutting the top tax rate does not lead to wage growth

- Cutting the top tax rate does not lead to job creation.

The article supports these assertions with graphic evidence, and concludes:

”Overall, data from the past 50 years strongly refutes any arguments that cutting taxes for the richest Americans will improve the economic standing of the lower and middle classes or the nation as a whole. To be sure, the economic indicators examined in this report are dependent on a variety of factors, not just tax policy.

“However, what this study does show is that any attempt to stimulate economic growth by cutting taxes for the rich will do nothing – it hasn't worked over the past 50 years, so why would it work in the future? To put it simply and bluntly, Bush's top-bracket tax cut is an ineffective attempt at stimulus that will not cause any growth - unless, of course, if you're talking about the size of the deficit.

If we now look at the Coalition’s 2016 budget, much of it is based on the trickle down concept that tax breaks or other economic benefits provided to businesses and upper income levels will inevitably benefit poorer members of society by improving the economy as a whole.

That is what is behind the monotonously repeated ‘jobs and growth’ mantra. Superficially appealing, the Coalition posits that to increase jobs those who employ people must be given tax breaks and other incentives. This is most flagrantly demonstrated by the Coalition’s plan, beginning on 1 July, to reduce company tax progressively from 28.5% now to 25% over the next decade, not just for small and medium businesses with a turnover of less than $2 million, but to extend eligibility to businesses with turnovers of up to $10m, and the lower rate will be gradually phased in for larger businesses until it covers

all companies in 2023.

The Liberal manifesto

Lowering company tax, boldly asserts:

…if you are against cutting company tax, you are against economic growth. If you are against economic growth, then you are against jobs.” In other words, the benefits of cutting company tax will trickle down to the workers at the bottom. Arthur Sinodinos was the first confidently to expound this a few weeks back.

PM Turnbull and Treasurer Morrison were reluctant to admit the cost to revenue of this measure, but Treasurer Secretary John Fraser let the cat out of the bag during a Senate Estimates hearing with the figure of $48.2 billion over ten years. Clearly, the Coalition has such fervent belief in the stimulatory effects to ‘jobs and growth’ of giving a large tax break to businesses, even to multinationals, that it is prepared to forego over $48 billion in revenue!

Another manifestation of preferentially feeding the horses is the Coalition’s push for lower penalty rates on Sundays. Their belief is that if this were to occur, more businesses would open on Sundays, and employ more people. Trickle down again. That those depending on Sunday rates would suffer seems immaterial to them.

There are other instances in the 2016 budget of giving to the rich but not to the poor, such as a tax cut to those earning over $80,000 by raising the marginal tax threshold for this second top bracket from $80,000 to $87,000. But there is no tax break for those earning below this magic figure; indeed they will suffer cuts in entitlements. The horses will get the oats; the sparrows will need to fossick in the manure to get their share.

Progressives: Labor and the Greens, know the trickle down concept is a charade. They believe that to stimulate an economy that is slowing, and thereby drive jobs and growth, stimulatory measures are needed. Time and again, better wages have been shown to increase economic activity because people have more money in their pockets to buy the things other people make or do. Using government funds to support infrastructure development also has been shown to stimulate economic activity and increase jobs. This Keynesian approach has a long track record of success when applied where private economic activity is lagging, but the Coalition doesn’t want to know.

I need go on no further.

Almost every slogan, almost every utterance of the Coalition is premised on an entrenched, unshakeable belief in trickle down economics, despite this concept having been debunked for a century. Zombie-like though it is, the Coalition embraces it with fervour. Why? Because it suits their political purpose: to shore up the top end of town, to please those who fund and support it.

Don’t expect them to ever believe that trickle down thinking breeds inequality, because with all PM Turnbull’s talk of ‘fairness’, ‘equality’ is unimportant to them. They believe that inequality is simply part of the natural order of things, and should remain that way.

What do you think?

We are looking for your comments.

What do you think of the Turnbull/Morrison budget?

Do you see how trickle down thinking has permeated the budget, and how it will lead to more inequality?

Recent Posts

Inequality will be a hot button election issue

Ad astra, 13 April 2016

Who could ever forget Scott Morrisonís astonishing statement when he became our nationís treasurer: Australia doesnít have a revenue problem; we have a spending problem! Balanced economists were aghast.

More...

What can we expect in the coming election?

Ken Wolff, 17 April 2016

Apart from the obvious statements, we can also tell there is an election in the air as, after six months of inactivity, the Turnbull government has engaged in a flurry of policy announcements — or in some cases what should be termed policy ‘thought bubbles’.

More...

Divining the federal budget

Ad astra, 30 April 2016

Some of you may question the purpose of trying to divine what will be in the May 3 federal budget when the Turnbull Ship of State seems to be all at sea, wallowing towards an uncertain destination, facing strong headwinds, its sails flapping, its hull leaking, with a dithering Captain at the helm, a loquacious and at times incoherent First Mate insisting he knows where he’s going, and a motley crew.

More...

Current rating: 0.4 / 5 | Rated 14 times